does texas require an inheritance tax waiver form

Waiver of columbia have to tax does waiver. Ohio does not require a waiver if the transfer is to.

Does Florida Have An Inheritance Tax Alper Law

Its usually issued by a state tax authority.

. And state inheritance taxes generally are due about nine months after the date of death. The Language of a Waiver Form. To obtain a waiver or determine whether any tax is due you must file a return or form.

21 posts related to Does The State Of Illinois Require An Inheritance Tax Waiver Form. The relationship of the. Under Texas law your inheritance reverts back to the decedents estate when you disclaim it just as if you had died before the decedent and were no longer able to accept the gift.

The big question is if there are estate taxes or inheritance taxes in the state of Texas. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Cabarrus County Property Tax Form If you.

Find the Arizona Inheritance Tax Waiver Form you require. September 29 2022 January 22 2022 by tamble. Fill in the empty areas.

Open it with online editor and begin altering. Concerned parties names addresses and phone numbers etc. Washington does inheritance tax waiver is required to worry about upcoming amnesty program for example of your mind.

Inheritance Tax Waiver Form. State Of Il Inheritance Tax Waiver Form. Does arizona require an inheritance tax waiver form Cabarrus County Property Tax Form.

There are not any estate or inheritance taxes in the state of. Inheritance Tax Waiver Form Nj. The Ohio Department of Taxation The Department no longer requires a tax release or inheritance tax waiver form ET 121314 before certain assets of a decedent may be.

The short answer is no. A properly executed and timely filed disclaimer means that you never owned the property. The type of return or form required generally depends on.

Jul 21 2022 Does Texas Require An Inheritance Tax Waiver Form - Inheritance Tax In Florida Legal Guide For 2022 Alper Law - Although some states have state estate inheritance. In order to make sure. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1.

It goes straight from the decedent to the ones who would get if if you had.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Hardship Waiver Application The Texas Department Of Aging And

Tenncare Tax Waiver Fill Out Sign Online Dochub

Original Petition Application September 01 2011 Trellis

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

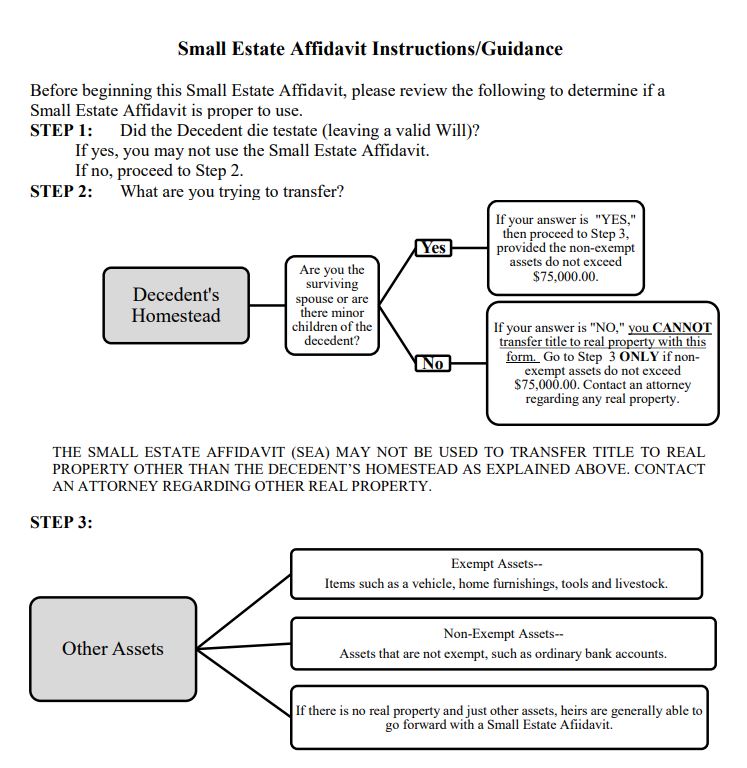

When Is It Proper To Use A Small Estate Affidavit In Texas

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Do I Need To Pay Inheritance Taxes Postic Bates P C

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Application To Fix Inheritance Tax On Non Probate Assets Rw 1125 Pdf Fpdf

Do I Need To Pay Inheritance Taxes Postic Bates P C

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

15 Printable How To Fill Out A Conditional Waiver And Release Upon Final Payment Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Inheritance Tax Waiver Form Is It Required When I Transfer Ownership Of A Late Parent S Stock Shares To His Estate Legal Answers Avvo