inheritance tax rate indiana

This marginal tax rate means that. It is not necessarily a fully proportional taxImplementations are often progressive due to exemptions or regressive in case of a maximum taxable amount.

How Do State And Local Sales Taxes Work Tax Policy Center

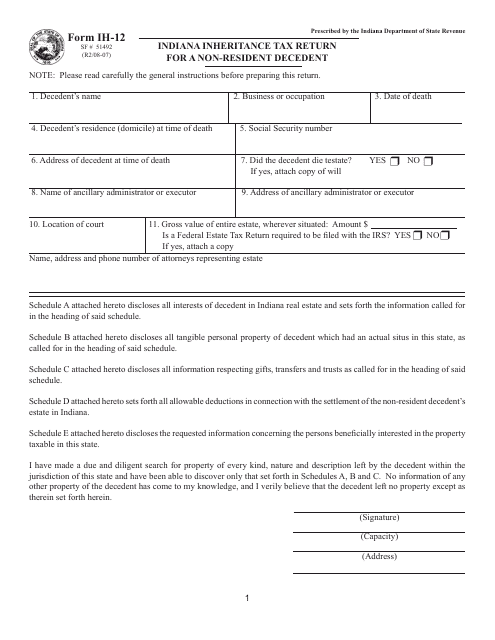

Indianas inheritance tax was repealed for individuals dying after December 31.

. There are various tax systems that are labeled flat tax even. Plus localities can add up to an additional. You can get forms.

1 2002 thru March 31 2008 6 Jan. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Make sure you keep below the inheritance tax threshold.

Pick-up tax is tied to federal state death tax credit. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. The county assessor is responsible for maintaining records for townships without a township assessor hearing real estate and personal property appeals and calculating inheritance tax.

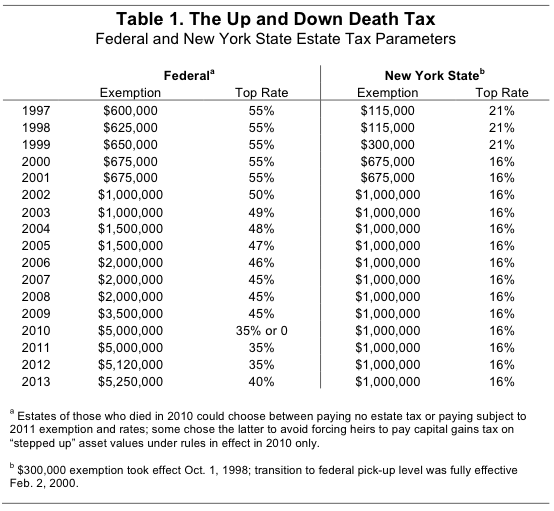

County Auditor All county financial records are kept by the county auditor. Rates and tax laws can change from one year to the next. International tax law distinguishes between an estate tax and an inheritance tax citation needed an estate tax is assessed on the assets of the deceased while an inheritance tax.

Pursuant to the US. Give your assets away. Tax burdens in 2020 2021 and 2022 are all higher than in any other year since 1978.

You would pay 95000 10 in inheritance taxes. Heres a breakdown of each states inheritance tax rate ranges. State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61 total rate.

If Indiana is the controlling state you may have to pay an inheritance tax if the decedent passed away on or before December 31. Your average tax rate is 1198 and your marginal tax rate is 22. The Indiana inheritance tax was repealed as of December 31 2012.

If you die within 7 years then inheritance tax will be paid on a reducing scale. Repeal of the Inheritance Tax Estate Tax and Generation Skipping Tax. Maryland is the only state to impose both.

The new inheritance tax allowance on property can be found here. Indiana Tax Bulletin E-newsletter - Click to Expand. Tax burdens rose across the country as pandemic-era economic changes caused taxable income activities and property values to rise faster than net national product.

You would receive 950000. IA ST 4512. A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base.

Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate. For example Indiana once had an inheritance tax but it was removed from state law in. If you make 70000 a year living in the region of Arizona USA you will be taxed 10973.

The IRS will process your order for forms and publications as soon as possible. Twelve states and Washington DC. 5 on total sales.

1 1983 5 May 1 1973. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. If you dont have a record of filing an amended Indiana tax return for 2017 or of resolving a claim or dispute related to your 2017 return during 2020 you may contact DOR for an.

Please contact Savvas Learning Company for product support. Go to IRSgovOrderForms to order current forms instructions and publications. Motor Carrier Fuel Tax Rate.

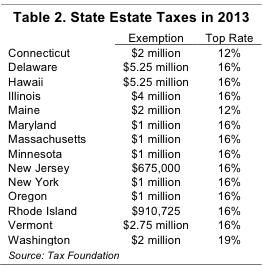

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance taxTwelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes. For individuals who die after that date no inheritance tax is due on payments from. The estate would pay 50000 5 in estate taxes.

April 1 2008 thru present 7 Dec. Ordering tax forms instructions and publications. This replaced Indianas prior law enacted in 2012 which phased out Indianas inheritance tax over nine years beginning in 2013 and ending on December 31 2021 and increased the inheritance tax exemption amounts retroactive to January 1 2012.

Sales Tax Rate History. Impose estate taxes and six impose inheritance taxes. Be aware that closing a business with DOR does not end your obligations to.

Supreme Courts 1992 decision in Quill Corp. The Indiana use tax rate is seven percent same as our sales tax rate. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Americas 1 tax preparation provider. Call 800-829-3676 to order prior-year forms and instructions.

Indiana once had an inheritance tax but it was repealed in 2013. 1 online tax filing solution for self-employed. Dont resubmit requests youve already sent us.

From July 1 2022 to June 30 2023 the Gasoline Tax rate is 033 per gallon the combined state and federal rate is 0504. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property of a person who has died.

Based on the difference between the maximum State Death Tax Credit allowable at the federal level and the amount paid in state Inheritance Tax. Self-Employed defined as a return with a Schedule CC-EZ tax form. About the Supreme Courts Decision.

Indiana Tax Exemption Relating to the National Football League and Its Affiliates. Replaced by General Tax Information Bulletin 206. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

North Dakota sellers without a physical presence in a state were not required to collect and remit sales tax to that particular stateOn June 21 2018 the Court issued its ruling in South Dakota vWayfair Inc overturning its prior decision in Quill such that physical presence is no. 2012 Legislative Changes to Inheritance Tax. If you give assets away and you survive for at least 7 years then all gifts are free and avoid inheritance tax.

Inheritance Tax Forms - Click to Expand. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax account isnt closed on INTIME or the BC-100 isnt filed DOR may continue to send bills for estimated taxes.

Henry S Indiana Probate Law And Practice Lexisnexis Store

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Henry S Indiana Probate Law And Practice Lexisnexis Store

Jefferson County Ky Property Tax Calculator Smartasset

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Federal Estate Tax Return Requirements Tax Are Afforded To A Qualifying Widow Hadleysocimi Com

Annuity Taxation How Various Annuities Are Taxed

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Annuity Taxation How Various Annuities Are Taxed

Guide To Inheriting A House With Siblings Inheritance Funding

Federal Estate Tax Return Requirements Tax Are Afforded To A Qualifying Widow Hadleysocimi Com

How Do State And Local Sales Taxes Work Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy