georgia film tax credits for sale

Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. Offset up to 100 Corporate Income Tax 100 Personal Income Tax.

Essential Guide Georgia Film Tax Credits Wrapbook

Income Tax Credit Policy Bulletins.

. Film television and digital entertainment tax credits of up to 30 percent create significant cost savings for companies producing feature films television series music videos and commercials as well as interactive games and animation. Placed over 35 Million of Georgia Film Tax credits with buyers in 2015 Sold Millions of Illinois credits specializing in tax credits for television and commercial projects Multiple multi-Million Dollar sales in Louisiana including a 23 Million Dollar Louisiana Film Tax Credit sold for a major motion picture studio in 2015. How to File a Withholding Film Tax Return.

The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits. How-To Directions for Film Tax Credit Withholding. Transfer prices can range from 070 to 118 per dollar of credit purchased.

Georgia Issues Film Tax Credit Guidance Addressing Georgia Vendor Requirements Production companies in Georgia who purchase or rent property from vendors located in Georgia may not be able to get film tax credits for the cost of obtaining that property if the vendor is really a conduit. They get an additional 10 for providing that cool Georgia Peach logo. Taxpayers will pay for a tax credit and receive anywhere from a 5 to 15 discount on the value of the film tax credit depending on the state tax year amount and seller profile.

To the extent the credit exceeds a companys Georgia income tax it can be claimed as a credit against its withholding tax and then further can also be sold to another taxpayer. Get More We broker the sale of state entertainment tax credits from film production studios to taxpayers so both buyer and seller leave satisfied. To see what film tax credits are offered across the country hover over the map.

Heres a Georgia film tax credit example. The way it works is that production companies get a 20 credit on what they spend for certain expenses while making their project. An additional 10 credit can be obtained if the finished project.

For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. Income Tax Credit Utilization Reports. In order to take advantage of Georgias film tax credits most production companies transfer or sell them to other taxpayers.

The Georgia State Income Tax Credit Program for Rehabilitated Historic Property allows eligible participants to apply for a state income tax credit equaling 25 percent of qualifying rehabilitation expenses capped at 100000 for a personal residence and 300000 5 million or 10 million for all other properties. Tax The Georgia film credit can offset Georgia state income tax. As they may often not have income tax liabilities of their own these companies sell the credits to brokers who then resell them to Georgia taxpayers at a discount.

Your benefit is 2100. You will receive a red errorwarning message about K-1s which you can ignore. The price is determined by market forces in the transferrable tax credit markets with a minimum of 60 cents per dollar.

Please note that discounts fluctuate. Georgia Tax Center Information Tax Credit Forms. Instructions for Production Companies.

Register for a Withholding Film Tax Account. For example you purchase 30000 of tax credits for 27900. The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year.

The 500 of withholding would be eligible for a refund. One reason many production companies select the state is because of the robust saving opportunities available through the Georgia Film Tax Credit. Georgia has several excellent brokers for sales of film credits.

Money to buy the credits. Beyond the potential to deliver a high rate of return to buyers and reduce effective tax. 20 percent base transferable tax credit.

Film tax credit In order to encourage the production of films in Georgia the state permits film production companies a credit of up to 30 of their qualified expenditures in Georgia. Film tax credit GA. The program is available to production companies that spend at least 500000 on production and post-production in Georgia either in a single production or on multiple projects.

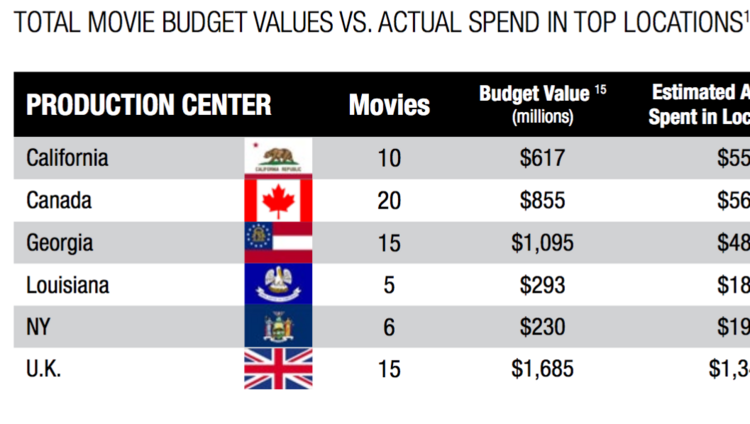

Credit amounts depend on if the transfer is at the federal or state level the type of credit the types of taxes that may be offset and whether additional tax attributes and priority returns are passed through to the investor. The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute to its economy. Both resident and non-resident workers payrolls and FICA SUI FUI qualify.

The accrued credits may be used by the production company against income taxes or employer withholding taxes or sold to a third party for use against income tax but not employment tax. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399 productions filmed representing a 29B infusion to the state economy. With transferable tax credits Georgia provides incentives worth 20 to 30 percent of a production companys total spending in the state benefits that can easily reach millions of dollars for a major movie.

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. This discount represents the savings to a particular taxpayer. Transferable tax credits arent the only way states provide tax incentives to companies that dont owe much in taxes.

Statutorily Required Credit Report. Credit Code 122 company name is the movie company no certificate 100 owner Federal EIN No and Credit Amount. Qualified Education Expense Tax Credit.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Includes a promotional logo provided by the state. If you make a movie and the whole movie costs me 10 million the.

Georgias Entertainment Industry Investment Act provides a 20 percent tax credit for companies that spend 500000 or more on production and. Income Tax Letter Rulings. The final tax credit sale to folks like you and me is usually at about a 10 discount so you would buy each 100 of Georgia tax credit for about 090.

For example the taxpayer has a 25000 Georgia tax liability and enters into a tax credit transfer agreement for 25000 of 2019 Georgia film tax credits from a Major Studio. In order to qualify individuals or corporations need to have. Georgia Film Tax Credits were created to entice production companies to come to Georgia and spend their money on movies films commercials etc.

Third Party Bulk Filers add Access to a Withholding Film Tax Account. Claim Withholding reported on the G2-FP and the G2-FL. FAQ for General Business Credits.

Opinion Ga S Film Tax Credits Are Big Budget Flop

Novae Money Credit Repair Buildworth Strategies Credit Repair Reviews Credit Repair Agent Re Credit Repair Credit Repair Companies Credit Repair Business

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Film Tax Credits Cabretta Capital

Email Encouraging Gifts Prior To Fiscal Year End The Emails Were Customized Based On The Recipient S Major Fiscal Year Fundraising Fiscal

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

Eliminate Buyer Resistance With Watch Time Video Time Is Money Saving Money Tax Credits

Film Incentives And Applications Georgia Department Of Economic Development

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Pin By Osangungaaje On Loafers Men In 2022 Loafers Men Dress Shoes Men Oxford Shoes

![]()

Georgia Film Tax Credits Cabretta Capital

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Streaming Dominates The Music Industry S Revenue Engadget Music Sales Music Industry Vinyl Sales

Georgia Film Tax Credits Cabretta Capital

Film Television And Digital Entertainment Tax Credit Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

Clark Adams Co Windows And Doors Spring Window Sale Sale Windows Spring Window Advertising Graphics